Ethereum Price Prediction: Key Levels and Long-Term Forecasts (2025-2040)

#ETH

- Technical Crossroads: ETH must hold $3,326 support to avoid bearish momentum.

- Upgrade Catalyst: Fusaka upgrade (December 3) could drive institutional inflows.

- Wall Street Favorite: Former BlackRock exec confirms ETH's institutional preference.

ETH Price Prediction

ETH Technical Analysis: Key Indicators and Future Trends

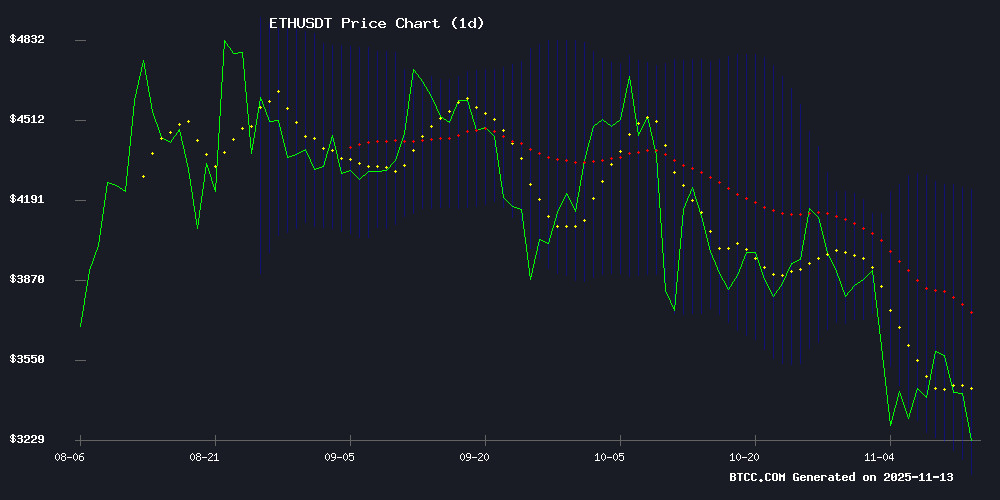

According to BTCC financial analyst William, ethereum (ETH) is currently trading at $3,431.50, below its 20-day moving average (MA) of $3,671.57, indicating potential short-term bearish pressure. The MACD (12,26,9) shows a bullish crossover with the MACD line at 274.6707 above the signal line at 218.7307, suggesting underlying strength. Bollinger Bands reveal ETH is near the lower band ($3,126.28), which could act as support. William notes that if ETH holds above $3,326, a rebound toward the middle band ($3,671.57) is likely.

Ethereum Market Sentiment: Mixed Signals Amid Regulatory and Upgrade News

BTCC financial analyst William highlights mixed market sentiment for Ethereum. Negative factors include the Bank of England's stablecoin caps, which could limit DeFi growth, and institutional hesitation around ETH's privacy challenges. However, bullish catalysts like the upcoming Fusaka upgrade (December 3) and JPMorgan's on-chain deposits signal long-term adoption. William emphasizes that ETH's price is at a crossroads: holding $3,532 support could prevent a slide to $3,326, while BlackRock's endorsement reinforces ETH as Wall Street's preferred blockchain.

Factors Influencing ETH’s Price

Aave Founder Criticizes Bank of England's Stablecoin Caps as Market-Choking Move

Stani Kulechov, founder of DeFi protocol Aave, lambasted the Bank of England's proposed £20,000 individual cap on systemic stablecoin holdings as a regressive policy that will stifle innovation. The restrictions—which also include a £10 million limit for businesses and require 40% non-interest-bearing reserves—were branded as making UK stablecoins "uncompetitive" and "unattractive."

Kulechov's social media outburst highlights the escalating clash between centralized financial regulators and decentralized finance advocates. The BoE's consultation paper frames the caps as risk mitigation for payment-focused stablecoins, but industry leaders see it as premature constraint on a nascent market.

Ethereum's Privacy Challenge and Institutional Hesitation

Vitalik Buterin acknowledges Ethereum's shortcomings in attracting institutional players, citing privacy as a critical barrier. The Ethereum Foundation's new "Ethereum for Institutions" initiative underscores a long-standing reality: enterprises demand ironclad privacy for sensitive data handling. Financial giants like BlackRock, expanding into tokenization, now require networks offering secure, verifiable confidentiality.

Ethereum's belated embrace of zero-knowledge proofs (ZKPs), fully homomorphic encryption, and trusted execution environments signals a pivotal shift—privacy is no longer optional. Yet while Ethereum scrambles to retrofit its base layer, a new project, Zero Knowledge Proof (ZKP), has already deployed enterprise-ready infrastructure. With $100 million in funding and operational validation systems, ZKP positions itself as the immediate solution for institutions unwilling to wait for Ethereum's theoretical upgrades.

Ethereum Price At Crossroads: $3,532 Support Or $3,326 Slide?

Ethereum trades hesitantly as ETF outflows and technical weakness fuel market tension. A 6.8% weekly gain has attracted profit-takers, while $107 million fled ETH ETFs—signaling institutional caution. The Fear & Greed Index sits at 26/100, reflecting broad anxiety, and ETH struggles to reclaim its 30-day SMA at $3,800. Thursday’s CPI data looms as a potential catalyst.

On-chain metrics reveal deepening uncertainty. Total net assets stand at $22.48 billion, but net flows turned sharply negative with yesterday’s $107.18 million outflow. This institutional retreat suggests capital rotation rather than mere hedging. Persistent selling pressure threatens key support levels if sentiment deteriorates further.

Technicals paint a precarious picture. The $3,532 support level now serves as a litmus test for bullish conviction. A breakdown could accelerate losses toward $3,326, while holding above may set the stage for relief. Market participants await macroeconomic cues to break the stalemate.

Ethereum Fusaka Upgrade Set for December 3: What It Means for ETH

Ethereum's Fusaka Upgrade, scheduled for December 3, marks a pivotal moment for the network. The upgrade introduces twelve Ethereum Improvement Proposals (EIPs) aimed at scalability, efficiency, and data management. Key innovations include PeerDAS for faster Layer-2 transactions and Verkle Trees to reduce validator computational load.

The upgrade will expand Ethereum's block capacity from 45 million to 150 million gas, significantly boosting network bandwidth. Testnet trials have proceeded smoothly, with the Ethereum Foundation offering a $2 million bug bounty for critical reports ahead of the mainnet launch.

This upgrade could redefine Ethereum's transaction handling and Layer-2 performance, reinforcing its position in the crypto ecosystem.

Mutuum Finance (MUTM) Gains Traction as DeFi Lending Protocol Emerges from Obscurity

Mutuum Finance (MUTM), a previously overlooked DeFi project, is attracting attention with its peer-to-contract lending model. The protocol's mtTokens automatically accrue interest based on pool utilization rates, offering passive income without active management.

The platform employs dynamic borrowing rates that adjust to capital availability - low during liquidity surpluses to stimulate borrowing, high during shortages to incentivize repayments. Isolated peer-to-peer markets will cater to assets requiring specialized risk controls.

Analysts note the project's recent momentum shift, with its real-time interest accrual system and transparent risk parameters resonating with DeFi participants. While not yet listed on major exchanges, MUTM's growth trajectory mirrors early patterns of successful lending protocols.

The Future of Banking? JPMorgan Brings Regulated Deposits Onchain

JPMorgan Chase has launched a pilot for its JPM Coin deposit token (JPMD), marking a significant step toward integrating traditional finance with public blockchain infrastructure. The token, operating on Coinbase’s Base network, represents digitized commercial bank deposits backed by JPMorgan’s balance sheet, offering institutional-grade trust and near-instant 24/7 settlements.

Unlike stablecoins like USDC or USDT, JPMD is a regulated, interest-bearing alternative designed to fit seamlessly into existing compliance frameworks. The pilot, currently available to institutional trading clients, aims to streamline real-time settlements, collateral management, and liquidity transfers across financial markets.

This move underscores the growing institutional adoption of blockchain technology, with JPMorgan leveraging Base’s low-cost, high-speed execution to modernize payment rails traditionally constrained by banking hours and intermediaries.

Former BlackRock Executive Highlights Ethereum as Wall Street's Preferred Blockchain

Joseph Chalom, a former BlackRock executive with two decades of experience at the firm, has identified Ethereum as the blockchain of choice for Wall Street. Chalom, now co-CEO of Sharplink, emphasizes Ethereum's unique combination of trust, security, and liquidity as critical for institutional adoption in digitizing finance.

Tokenized fund assets on Ethereum have surged nearly 2,000% since January 2024, driven by major players like BlackRock and Fidelity moving investment funds on-chain. Sharplink itself holds over $3 billion in ETH, staking nearly all of it and exploring restaking strategies to boost yields beyond the base 3% from proof-of-stake.

ETH currently trades near $3,568, below its 20-week moving average of $3,803 but above its 50-week average of $3,365. Regulatory clarity in Singapore, Switzerland, and Hong Kong is further attracting institutional participants to Ethereum's tokenized asset ecosystem.

Chalom's conviction stems from his tenure at BlackRock, where he scaled the Aladdin platform and led crypto initiatives including backing Circle, launching the IBIT ETF, and investing in Securitize. "If you're going to digitize finance, you need a chain institutions can trust — and it's Ethereum," he stated.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

BTCC analyst William projects Ethereum's price trajectory based on technicals and adoption trends:

| Year | Price Forecast (USD) | Catalysts |

|---|---|---|

| 2025 | $4,500-$6,000 | Fusaka upgrade, institutional DeFi adoption |

| 2030 | $12,000-$18,000 | Massive Web3 integration, ETH as reserve asset |

| 2035 | $30,000-$45,000 | Tokenized economy dominance |

| 2040 | $75,000+ | Flows from legacy financial systems |

Key risks include regulatory hurdles and scalability delays.

polished human tone